Hello

In this month’s issue, we:

- Discuss how to effectively manage your employees remotely Read more…

- Take a closer look at reasonable additional hours Read more…

- Share some advice on how to manage injuries at work Read more…

- Explain termination during a probation period Read more…

- Provide the important dates you need to know for 2023 Read more…

If you have any questions or require further information regarding any of the content covered by this edition of The Source, please do not hesitate to contact us!

Best regards,

Kerrie, Sally and the Team at HR Advice Online

Salary Reviews – How often should these be reviewed?

Where an applicable modern award provides an annualised salary arrangement provision, employers are able to annualise an employee’s wages over a 12 month period. In doing so, the employee will be paid a set amount which is in satisfaction of additional remuneration entitlements provided for under the award.

Whilst there are some differences between the annualised wage clauses provided within the various awards, the following obligations on the employer are generally consistent across each of the awards in respect to annualised salary clauses and arrangements:

- An employer is required to advise the employee and record the amount payable, including documenting:

- the terms of the award satisfied by the annualised wage arrangement and

- the outer limit of the number of hours (comprising of ordinary and/or overtime hours) for the pay period that applies to the employee. Which are compensated for by the annualised salary;

- For each pay period, the employer must check if an employee has worked outside the limits that the annualised salary covers and if so, pay them the excess for that pay period.

- At least every 12 months, or upon termination, the employer must undertake a reconciliation exercise to ensure each employee has not been underpaid.

If any underpayment is identified (i.e., the employee has received less than what they would have received under the award for the work performed) then the employer must top up to compensate for the underpayment.

- The employer must diligently record and keep records of employee working hours (starting times, finishing times and unpaid breaks taken).

Tips for checking and ensuring compliance:

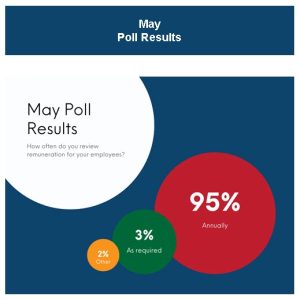

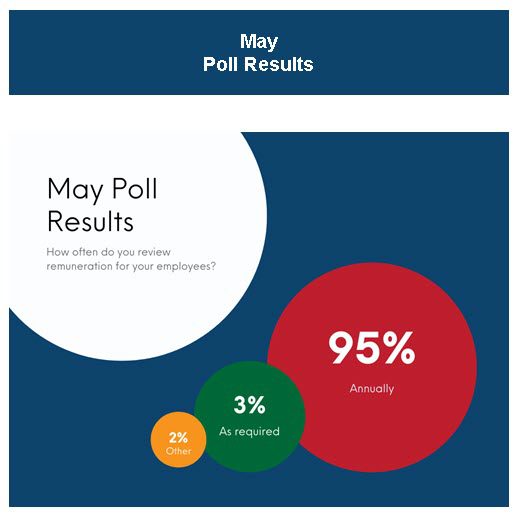

- Undertake regular salary reviews;

- Ensure compliance with the annualised salary provisions of an applicable award; and

Review records and record-keeping practices